As featured in Fortune Term Sheet.

Life for newly public and soon-to-be public venture-backed tech companies Marin Software, Marketo and Tableau is about to get much tougher. When these companies go public, their shareholder base will begin to shift from VCs to public funds. Even for strong companies such as these, this shift can be punishing for those who don’t manage the transition well. If you’re a growth stage entrepreneur looking to go long, you’ll have a similar challenge when you go public. New analysts and fund managers will want your time. The types of questions you’ll field from these folks will often be very different than those from your VCs – they’ll get very specific about competitors, customers, and suppliers and also ask open ended, big picture questions. It can be unclear what they’re getting at. Knowledge of who is buying, selling, holding and/or shorting can be sporadic. Meanwhile, your stock price can vacillate up and down on unrelated and seemingly unimportant news.

The suggestions below aim to help you navigate the bumpy terrain you’ll confront as a newly public company:

Dos

Focus on fundamentals; don’t forget what got you public in the first place. If you’ve gotten public, you’re doing a lot right. Your recipe for success as a public company shouldn’t change. If you’ve built your culture to focus on the customer, this should remain consistent even after you’re public. Similarly, if you’ve rallied your company around an audacious goal, don’t be afraid to share it with public investors (but expect them to hold you to this goal over time). IPOs and the inevitable increased media attention can be very distracting to your employees and a drag on performance. It’s critical you keep your team focused on business as usual to maintain success.

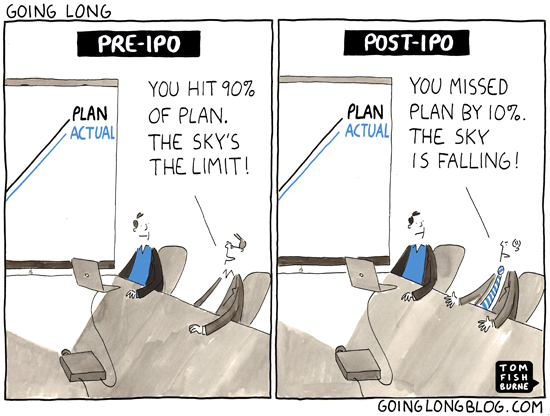

Be long term greedy, not short term greedy. It can feel euphoric to let future expectations run wild, but it can cause big headaches down the road when you’re held to these lofty projections. Instead, keep expectations tamped down wherever possible. This runs counter to typical private company behavior, where VCs push you to think big, make bold projections and reward the achievement of 80-90% of your plan. When you’re public, missing numbers by 10% can have disastrous effects. Keeping expectations low may depress your stock price, but if you make money for institutional investors and establish credibility with them by achieving or beating numbers consistently, you’ll earn their support.

Be respectful of the investment community. Once you’ve gone public, you’ll inevitably have a ton of demands on your time. You need to balance being available with the risk of losing focus on your business. Be consistent – don’t go silent if you’re in the midst of a rough patch in your operations and don’t turn off to investors or analysts who are negative on your stock. Recognize that sell-side analysts are a point of leverage – they help you keep your story out in front of investors.

Don’ts

You risk losing credibility if you’re overly optimistic about your business and its performance. There are no secrets in today’s world – err on the side of over-transparency. Savvy public investors know that no business is perfect; everyone has unhappy customers, product challenges and competitive weaknesses. Public investors are adept at digging up very granular information via surveys, channel checks and, increasingly, social media. The more you try to bury challenges you’re facing, the less control you’ll have over the storyline on these issues when they surface. This doesn’t mean you need to issue a press release every time you receive an angry tweet, but by consistently providing a balanced assessment of your performance and prospects, you’ll preserve credibility, allowing you to better navigate the tougher issues as they arise.

Performance will suffer longer term if you solely focus on optimizing quarterly results. The Wall Street treadmill will pressure you into running your business quarter to quarter. You can’t ignore this framework completely, but you won’t achieve your long term goals if you get overly consumed with hitting your targets in 90 day increments. You need to find balance internally, ensuring your best people are focused on achieving important long term objectives while you’ve also got a well oiled machine that can churn out predictable near term results.

Public investors deplore you using their money unwisely. Investors want to feel they’re partnering with management teams who run the business as if they owned the whole company. For example, paying an unreasonably high acquisition price for a start-up because it’s sexy and in vogue is a yellow flag. As an example, VMWare’s recent purchase of Nicira will be scrutinized for several years. Would management have acquired this nascent company for over $1Bn if they had to pay for it with their own cash and/or equity? This isn’t to say that all M&A is bad. For example, Priceline’s acquisition of Booking.com has driven enormous value for shareholders and made sense from the start. In M&A and all other aspects of your business, treat the capital as if it were your own and show your investors this is how you gauge every decision.

Without doubt, life as a public company will differ greatly from private company days. There is no universal blueprint for success when public, but following these recommendations will help rudder your ship as you navigate the waters.