As reported in Forbes.

The Covid-19 pandemic has upended almost every facet of our lives; enterprise software companies, from startups to multibillion-dollar public companies, have not been immune to 2020’s headwinds. Yet this sector also benefited from the mass shift to work-from-home and accelerated digital adoption. For the last decade, companies have been transitioning their business processes, applications, and data to the cloud, and COVID-19 simply sped up this digital transformation.

As an investor in the software industry for over 20 years, I wanted to explore the impact of the pandemic on enterprise companies and what their CEOs predict will happen to their businesses in 2021. So I conducted an informal survey; I polled 25 CEOs of top software companies, from growth-stage to pre-IPO, listed in this year’s Forbes Cloud 100, and 17 responded. It’s hardly a scientific study, but the CEOs’ responses were illuminating, proving the pandemic has hurt many software companies’ 2020 top-lines but also provided unprecedented opportunities for growth.

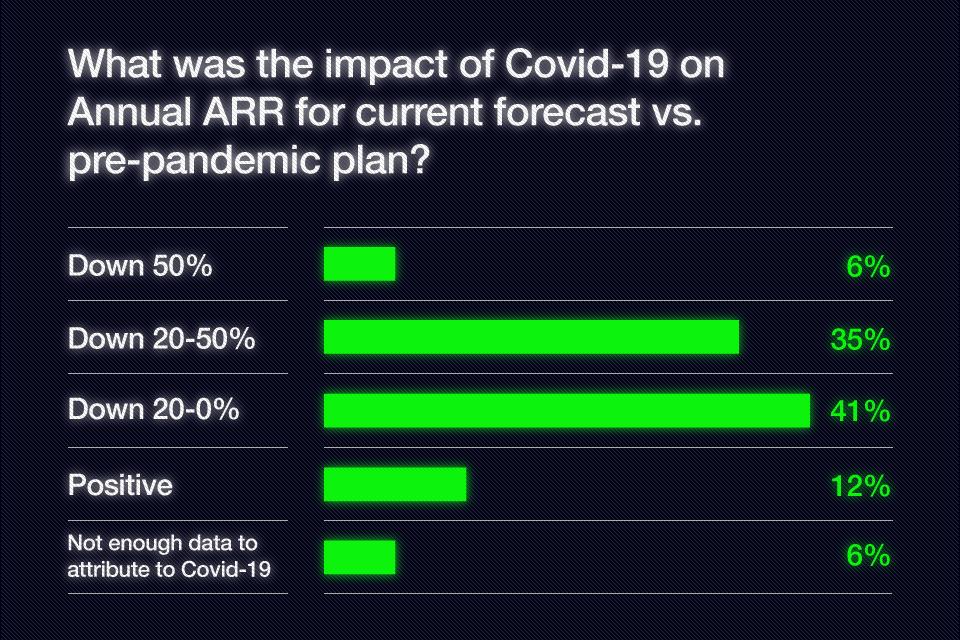

Nearly 90% of respondents say the COVID-19 pandemic negatively impacted their 2020 top-line results. Seven companies project their top-line annual ARR to come in up to 20% below their pre-COVID plan, while six project results that are 20-50% below their pre-COVID plans. Two companies actually project higher ARR than planned pre-COVID, proving some software business models flourished during work-from-home orders. Not surprisingly, however, the overall top-line impact of the pandemic for this group was negative in the down 20% to down 50% range. Yet valuations for many private enterprise software companies surged during the pandemic; public market funds and venture investors alike clearly believe organizations will continue their digital transformations via cloud computing, AI, and open source.

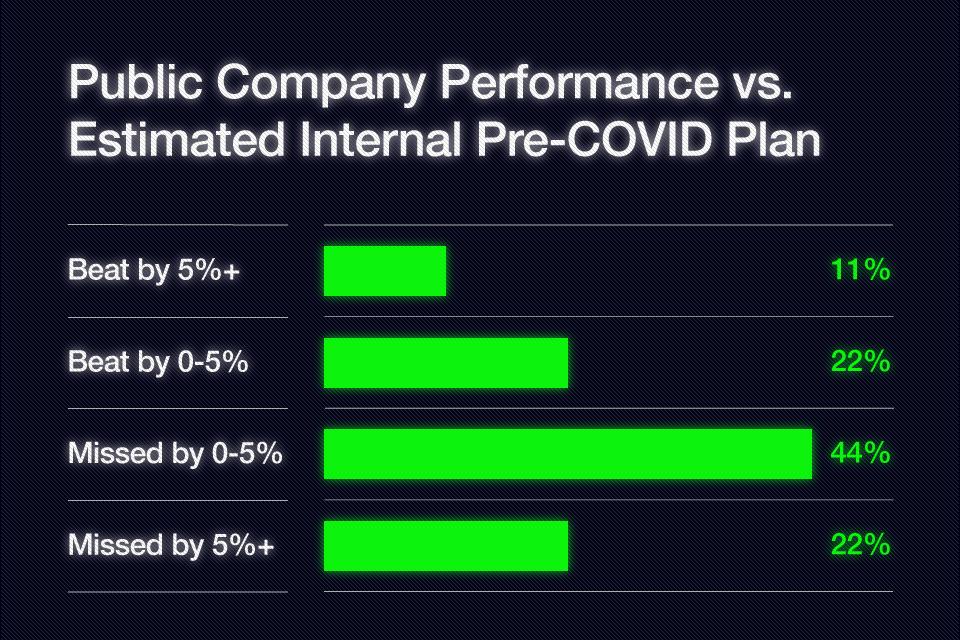

Interestingly, many public cloud companies also underperformed in 2020 compared to projected guidance, but they seemed to have weathered the pandemic better than private cloud companies. GGV took a look at published financial records for 36 public cloud companies, and, in aggregate, roughly two-thirds of these companies undershot our estimate of their internal, pre-COVID top-line plans for 2020, but they did so by a smaller margin than the 17 private companies I surveyed. Their median underperformance compared to plan was -2.9%. The other one-third of the public companies we examined actually exceeded our estimates of their internal, pre-COVID top-line plans.

Why did public cloud companies perform better than private ones in 2020? We don’t think public cloud companies are necessarily higher quality than private ones, but, more likely, they were not growing as fast as their private counterparts leading into COVID, so they didn’t have as high a hill to climb to maintain planned internal growth assumptions. It has also been easier to sell new business into existing accounts than to find new accounts during the pandemic, giving public companies with a large installed base an advantage. [Note: To identify the public companies’ internal pre-COVID growth plans for 2020, we took the simple average growth rate from the full-year 2020 public guidance these companies offered when reporting their Q4 ’19 results, just prior to the pandemic, and the full-year growth these companies sustained in 2019. Although not perfect, this seems a pretty good proxy for most public companies’ pre-COVID 2020 plans.]

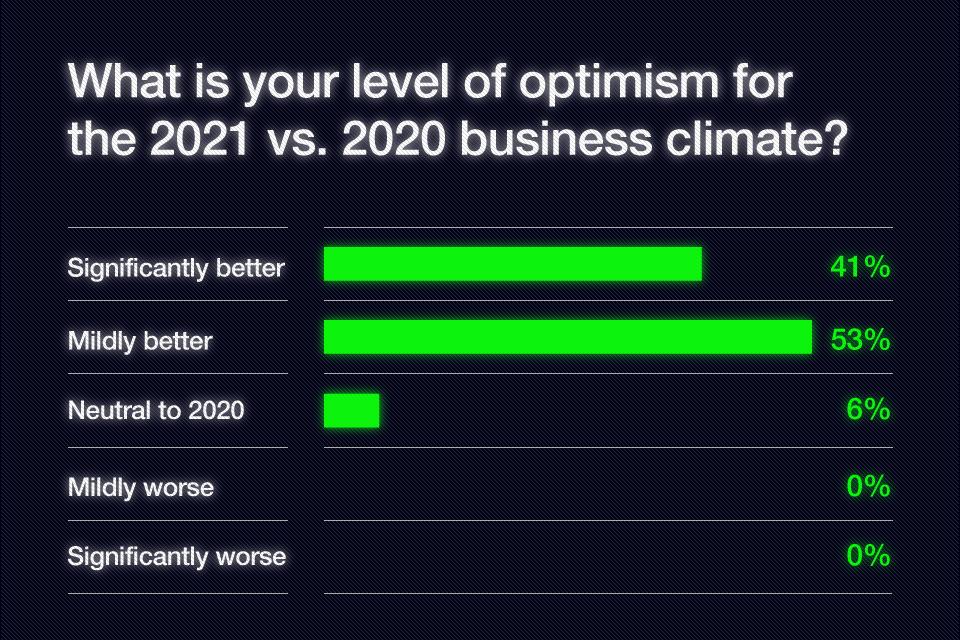

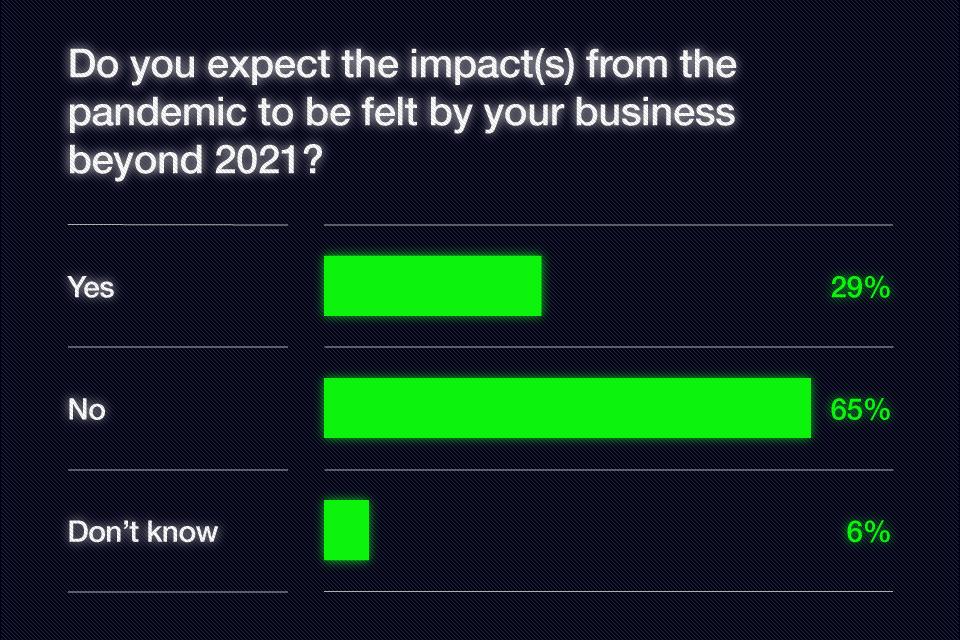

Private cloud companies are already recovering and confident regarding the future. Almost all of the software CEOs we surveyed are more optimistic about 2021 than they are with the reality of 2020. Out of the 17 respondents, 16 believe their businesses will improve in 2021. Seven said their businesses would perform significantly better in 2021, and nine thought business would be mildly better next year. Additionally, while no one knows how the pandemic will play out, two-thirds of the CEOs surveyed believe the pandemic will not impact their businesses beyond 2021.

Many of the CEOs we surveyed believe that, with vaccines becoming widely available, the world will return to some semblance of normal in mid-2021. “I see a massive upswing in in-person experiences such as entertainment, travel, and social engagement beyond pre-COVID levels as people ‘make up for lost time’, and with that, I see corresponding success for tech platforms enabling these,” said one CEO.

“2021 will be the perfect storm for enterprise software—massive IT budget increases, paired with a distributed workforce,” said one CEO. Seeing strong demand for remote workforce technologies, security infrastructure, and data capture and analytics software, the CEOs were confident revenues would improve. “There will be a sustained momentum in digital transformation even as we move past COVID,” predicted one CEO, while another expects an “acceleration of technology that connects people and teams and that creates more business agility.”

As demand for enterprise software booms in 2021, the CEOs believe a shakeout may come later in the year. “Competition between cloud providers will lead to lower margins, with each cloud trying to differentiate themselves with exclusive software,” said one CEO. Another commented that we should expect to see “much higher volatility between the winners and losers, and if the model is right, business will accelerate; if it is not, there will be no room for error and companies will collapse.”

I believe the enterprise software companies that will succeed post-pandemic will fall into three broad categories: those that serve developers with offerings that win their hearts and minds utilizing open source and API-driven models such as Hashicorp, Confluent, and Stripe; those enabling knowledge workers through low-code or no-code apps, such as SmartSheet and Notion; and those helping organizations extract value from massive quantities of data, including Snowflake, Databricks, and MongoDB. Of course, these companies are already success stories, and many startups will emerge in an ecosystem around these winners in the next few years. With 2020 in the rearview mirror, I’m sure I speak for everyone in that I can’t wait to see what 2021 brings.