As published on LinkedIn.

Public cloud computing has surged into tech’s limelight, and many initial doubters are now adapting to the cloud computing wave. Larry Ellison, CEO of Oracle, famously remarked in 2008: “What the hell is cloud computing?… I have no idea what anyone’s talking about. I mean, it’s really just complete gibberish.” Fast forward to October 2017, when Oracle held its OpenWorld conference this year, the theme was “The Ultimate Cloud Experience.”

We have entered an age where no tech giant can afford to ignore the inexorable force of cloud computing. Major tech companies such as Microsoft, Google, IBM, Alibaba and, yes, Oracle have woken up to the reality that cloud is here, it’s real, and they are already behind Amazon.

When Amazon first launched Amazon Web Services (AWS), many thought it would just appeal to startups. But the convenience, speed, and flexibility provided by the public cloud have proven so attractive that even larger enterprises have been moving a growing percentage of their compute workloads to the cloud.

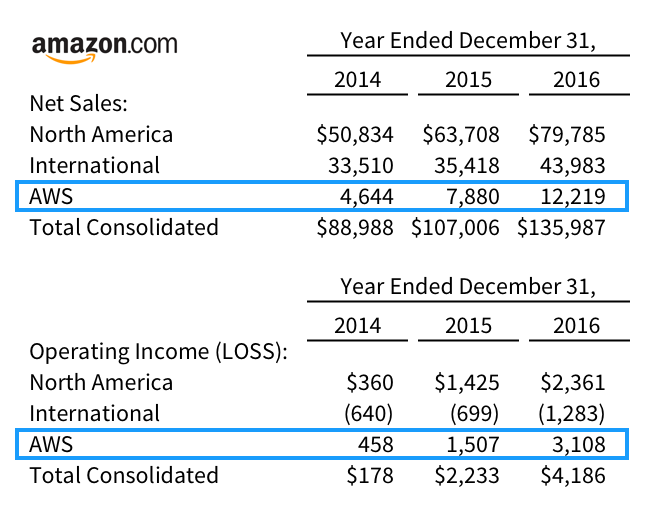

The explosive growth of AWS caught the market by surprise. In April 2015, Amazon broke out its cloud computing revenues generated by AWS for 2014 for the first time. It turned out that its cloud computing unit was nearly a $5 billion business that year and, to everyone’s surprise, Amazon’s most profitable sector. Since then, AWS revenue has nearly tripled in a two-year span. So did Amazon’s market capitalization.

The 2015 AWS disclosure was a watershed moment. Like Oracle, all other major tech companies realized they needed to get in the cloud game fast, and started redoubling their investments into cloud. These companies have deep pockets and they’re playing for keeps – the cloud opportunity is too big to ignore.

Every company is a software company that needs the cloud

Why has cloud become so indispensable to so many companies? Because pretty much every company has become a software company, and they all need to deliver their software faster and to more people than ever before.

Even in traditional industries, a company’s competitiveness increasingly depends on the quality of its software. Carmakers such as Tesla release new software frequently to power the next generation of smart automobiles. Airlines need fast, easy-to-use software to compete with aggregators in order to drive more bookings back to their own sites. Restaurants need well-designed software to ensure a seamless food delivery experience (More than half of Domino Pizza’s orders now come from online).

Software companies have better things to do than negotiate data center leases, purchase and install hardware, and manage and secure their infrastructure. With public cloud, they cannot only easily spin up a virtual machine with an API call, but also access a myriad of related services and building blocks (such as RDS, Lambda, Redshift, GKE, etc.) that are basically impossible to replicate in-house.

No time to waste

Driven by intense competition, the requirements for software products are constantly changing, so much so that companies need to release updates daily or even multiple times per day. The rise of CI (continuous integration) and CD (continuous deployment) is a direct consequence of today’s rapidly changing software requirements. Traditionally, those who wrote code and those who deployed code worked separately in silos, forming a bottleneck when deploying new software. Now, in order to realize a CI/CD workflow, many companies have integrated their Development and Operations groups through the “DevOps” role. DevOps helps companies seamlessly launch new features on a continuous basis and avail themselves of the flexibility and global nature of public cloud.

Additionally, the advent of containerization and micro-services software architectures is enabling companies to release updates quickly, burst availability when demand spikes, and make efficient use of public clouds. Containers bring an unprecedented level of portability, and micro-services architectures are inherently distributed, enabling the break-out of workloads across physical locations. Portability has shown initial value across development, staging and production. Hybrid environments – spanning public cloud for some portions of an application’s systems and physical, on-prem or co-located infrastructure for other parts – have become the norm, facilitating segregation for security purposes, for example.

Together, these trends have led to the use of multiple clouds, or “multi-cloud.” In particular, as the public clouds adopt native support for Kubernetes, multi-cloud momentum should continue to build.

Enter the multi-cloud era

Given the many growing public cloud options and intensity of the competition between the tech giants, we’re seeing a rapid move to multi-cloud amongst many large companies. As Armon Dadgar, co-founder and co-CTO of HashiCorp attests, “in almost every Fortune 500 account we are engaging, customers are either planning or using multiple cloud providers.”

There are several factors driving this phenomenon:

- Avoiding lock-in and saving cost. AWS has done a tremendous job winning the hearts and minds of developers by enabling a very seamless onramp for workloads, keeping pricing flexible and low, and relentlessly launching new services. As large companies have rapidly adopted AWS, many have begun to grow queasy over the very large annual costs that have accumulated and an uncomfortable reliance on the service. Many CIOs and CFOs have been burned before by vendor lock-in, and are now motivated to move their organizations to multi-cloud to keep pricing honest and protect themselves from over-reliance on AWS.

- Differentiation. As the public cloud market has evolved, the players are effectively attempting to differentiate. While AWS appeals to developers, Google’s Cloud Platform (GCP) has made a strong play for data scientists and analysts with heavy investment in tools and hardware to optimize machine learning-based workloads. Microsoft has attempted to counter by appealing to traditional Exchange, Outlook, Sharepoint and SQL Server users. Alibaba’s Aliyun is emerging as a logical choice for Chinese companies expanding globally. And, one can imagine that Oracle will accentuate its provenance in OLTP database workloads on its cloud. With many different options, there is unlikely to be a perfect “one size fits all” solution for the typical enterprise – and this is also driving use of multi-cloud strategies.

- Responding to cloud vendor pressure. Many enterprises I’ve spoken with also mention that part of their move toward multi-cloud from AWS has stemmed from top-down pressure from the cloud vendors. Microsoft in particular has been effective in converting existing traditional accounts into users of its Azure cloud service with incentives and discounts. In some cases, large customers are also able to wield power. For example, several GGV portfolio companies whose solutions reside at AWS have been strongly encouraged by retailer customers to provide a mirrored service on another cloud because they’d prefer not to have their data stored with Amazon given competitive fears.

- Resiliency, redundancy, performance and data sovereignty. Use of multiple cloud service providers enables deployment architectures resilient to failures such as the large S3 outage that occurred earlier this year. Additionally, companies often have an edge performance motivation, leveraging a diversity of broadly dispersed, in some cases geo-specific, cloud facilities to improve application delivery in far-flung markets at relatively low cost. For example, AWS was the first to open a region in the Middle East (Bahrain), which helps with customers trying to deliver to that geography. Data sovereignty regulations such as GDPR in Europe are also forcing global companies to adopt multiple clouds, which helps to keep data confined within local regions.

- M&A and consolidation. Many enterprises are now finding themselves multi-cloud by default. Acquired companies frequently introduce new cloud vendors to the mix. Additionally, as Dadgar has seen with HashiCorp’s many customers, multi-cloud is “the pragmatic reality of many different decision makers, enterprise agreements, and M&A.”

- Access to resources. Cloud infrastructure also brings another benefit: access to the latest hardware. Many tech companies nowadays need graphics processing units (GPUs) and solid state drives (SSDs) to enhance their machine learning capabilities. But this kind of hardware is increasing difficult to obtain for individual companies, as cloud giants negotiate for early, sometimes exclusive access to the latest hardware. Thus, companies that might need the latest GPUs to run their neural networks have no choice but to find available capacity, leading many to end up working with multiple clouds.

Startups can thrive by capitalizing on multi-cloud trend

The multi-cloud world can be a scary and confusing one, especially for companies in traditional industries that are just adopting software as a differentiator. However, the benefits are hard to ignore. A recent survey by RightScale found that 85% of enterprises now have a multi-cloud strategy, up from 82% in 2016. This creates immense opportunities for startups that can help companies work seamlessly across various different cloud providers. Startups that promise cloud neutrality – not being locked into one particular vendor – will have significant advantage in this new battlefield.

For startups riding the multi-cloud wave, some areas of opportunity include:

- DevOps & CI/CD Automation. Large companies are increasingly seeking to standardize processes around continuous integration and delivery, new feature rollout and provisioning cloud workloads. DevOps tools enable orchestration across clouds. By standardizing these processes, companies are able to adopt a multi-cloud strategy, utilizing the best provider for each workload. GGV portfolio company HashiCorp, CircleCI, and LaunchDarkly are all making strong progress along this theme.

- Application Monitoring & Visibility. To confidently move application workloads around different clouds, monitoring and visibility have become paramount. Spotting performance issues within containerized, micro-services based architectures adds to the challenge. Companies such as DataDog, Lightstep, SignalFX, Netsil, Instana, and others shine the light needed for enterprises to drive a multi-cloud strategy.

- Security & Compliance. The move to the cloud is inexorable. But one of the friction points for larger organizations, particularly in sensitive and regulated industries, has been fear around data loss. This concern is magnified when companies contemplate the use of multi-cloud strategies. For containerized applications, companies such as Stackrox, Twistlock, and Aqua focus on providing protection. Regulating and enforcing cloud policies is addressed by companies such as Evident.io and Vault (a product of HashiCorp).

- Big-Data Based Management, Automation and Applications. Big-data infrastructure (e.g. Hadoop, Spark, Kafka, etc.) is expensive to build and maintain. As more of this moves to the cloud, particularly when multiple clouds are contemplated, tools to optimize and granularly manage the data and infrastructure will become key. Unravel Data and Cerebro Data head a longer list of innovative companies in this area. Meanwhile, as the cloud vendors offer more powerful and sophisticated data warehousing and analytic tools themselves, enterprises recognize the risk of lock-in by adopting these tools, giving rise to the popularity of companies like Snowflake, which in theory gives much more control to the customer. We think this is an area with lots of opportunities. Similarly, as containerization continues to increase in popularity, managing storage for stateful applications will become difficult. Companies like Portworx tackle this problem and we see vast potential for new startups as well.

- Application Delivery and Smart Workload Management. Modern applications span many data centers and geographies, especially as enterprises contemplate multi-cloud strategies. Companies such as GGV portfolio company NS1 ensure efficient application delivery, while modern CDNs such as Fastly and Cloudflare help direct workloads across distributed and heterogeneous infrastructure. Similarly, solutions that ease the deployment and maintenance of packaged and custom applications in the cloud and enable portability amongst clouds have huge potential in our view.

- Data Portability. The cloud service providers have gotten extremely good at locking in their customers’ data with managed services. There is clearly an opportunity with cross-cloud data replication and portability, both for DR and prevention of lock-in. Companies such as Datos, Igneous Systems, Rubrik, and Cohesity show great promise here.

- Database Meets Cloud and Micro-services. Currently, traditional relational databases have been forklifted into the cloud. But they weren’t built for the scale, distributed nature, and heterogeneity of the multi-cloud world. NoSQL databases such as Cassandra and MongoDB are better suited for cloud-native applications, but micro-services architectures are still a strain on existing databases. More innovation is bound to occur here to help better accommodate distributed transactions and failure handling.

At GGV, we are excited to back companies that can make sense of and drive value from this new, complex ecosystem. Entrepreneurs that understand, embrace, and specialize in navigating this multi-cloud world will have a shot at being the winners in the multi-cloud wars. Please reach out to us with your multi-cloud startups and to share ideas on this dynamic opportunity!

Special thanks to Armon Dadgar, Edith Harbaugh, Kris Beevers, Bassam Tabbara, Crystal Huang, Daniel Lopez and Semil Shah for their advice, thoughtful reviews and edits.