As seen on forbes.com

Over the past two decades, two separate trillion-dollar enterprise software sectors have been created: SaaS software and public cloud. Today, we are in the early innings of the next trillion-dollar software wave: developer-driven software. These companies build technologies to make the software development and data management processes easier, faster, more secure and completely democratized.

But before delving into what this new software market encompasses, let’s take a look at what was created before and why developer-driven software is emerging now. First, there was SaaS. Salesforce went public 16 years ago, its IPO essentially ushering in the SaaS industry. Salesforce debuted with a market valuation of just over $1B. Fast forward to today: the company’s market valuation hovers around $160B and SaaS companies such as Shopify, Workday, Docusign, and Veeva have followed in Salesforce’s footsteps, all of them sporting valuations north of $30B. These and other SaaS players reinvented how companies purchase and utilize software, allowing their customers to pay monthly subscription fees and gain freedom from costly software installs, licenses, and endless upgrade cycles. Per the BVP Nasdaq Emerging Cloud Index, the value of emerging public companies primarily involved in providing SaaS solutions exceeds $1.7 trillion today.

In parallel with the emergence of SaaS, Amazon launched its public cloud service, AWS, about 14 years ago, ushering in the era of cloud computing. Companies building their own software and SaaS vendors alike have flocked to the cloud, moving application workloads en masse to public cloud infrastructure with its vast, on-demand scalability managed by AWS, Microsoft Azure and the Google Cloud Platform. Over those 14 years, these three franchises have grown to over $80B in annual cumulative revenue and have made Amazon, Microsoft, and Google, three of the top four most valuable companies in the world. The collective value of these three public cloud platforms easily exceeds $1 trillion in value and shows no signs of slowing.

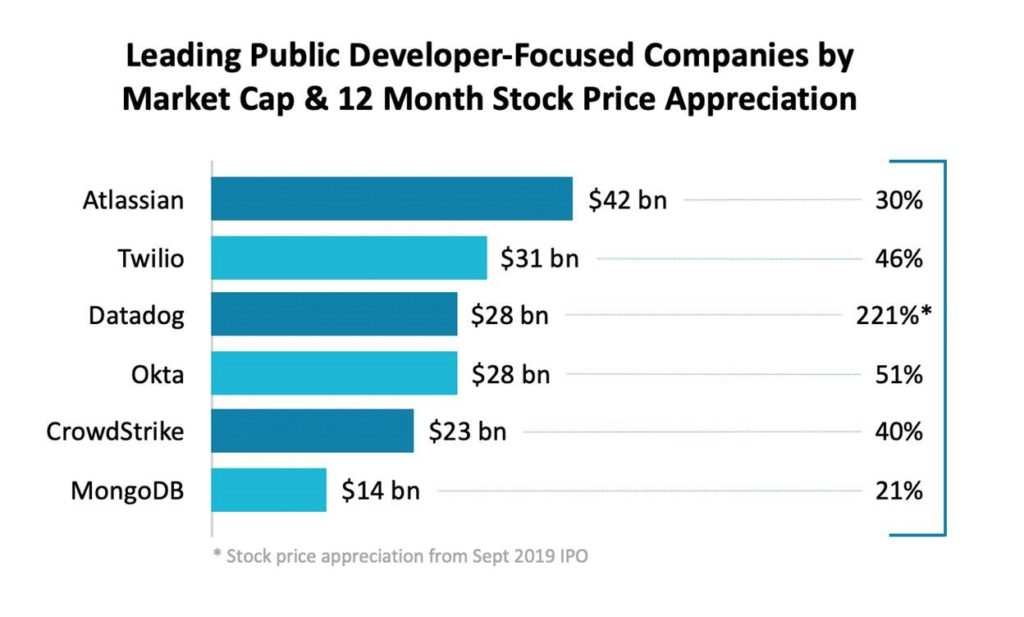

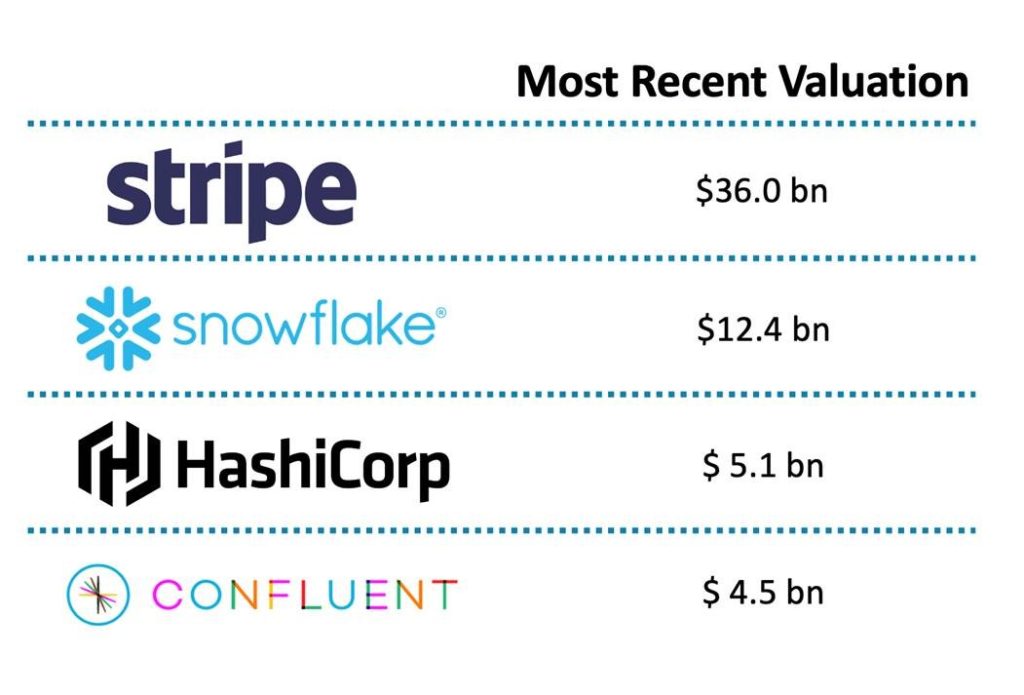

The evolution from SaaS to public cloud has led us where we are today: a new trillion-dollar industry is emerging around developer-driven software. It’s the logical next step in enterprise software value creation. A range of developer-driven software companies—from public leaders such as Twilio, Atlassian, Datadog, Okta, Crowdstrike and MongoDB, to pre-IPO unicorns including Stripe, Snowflake, and HashiCorp—are already valued in the billions or tens of billions of dollars. And despite the economic setbacks from COVID, this new market is continuing to gain momentum due to the shift to remote work. Unlike the developer tools market of the past that languished due to developers’ walled gardens and inability to pay for expensive, “packaged” tools, these newer products are readily available online, often free or at low cost, and shared widely across the global developer community. They are frequently built open source, inviting developers to contribute to and improve functionality over time, provided as APIs and SDKs that can be easily consumed to help power other applications, or are offered in a freemium model.

Tech-enabled pizzas (and cars, and shoes, and vacation rentals)

Why is this trend happening and what does it mean for the enterprise software industry as a whole? To understand why, think of the last time you ordered a Domino’s pizza. Chances are you ordered it via a mobile app or on the web. You built a pie or two with your favorite toppings using the interactive Pizza Builder, maybe added a few side salads, pasta dishes, and drinks, then hit buy and waited for the food to arrive at your doorstep. The process is a far cry from a decade ago when you had to call your local Domino’s to order by phone. Dominos is fast becoming a technology company. Ten years ago, the company’s stock price hovered around $12 a share; today, it’s around $380. Domino’s didn’t grow over 30X in a decade because people ordered 30X more pizza. It grew that fast because the company made it easy to order far more than just pizza. Average order sizes have climbed steadily since 2010 as Domino’s transitioned from a primarily phone-in order system to an app-based one that entices people to add extra items with just a click or swipe. The Domino’s app also makes ordering personalized, remembering customers’ pizza preferences and offering promotions on their favorite meal items. Today, over 70% of Domino’s sales are on web or mobile. And, on the backend, Domino’s has invested heavily to upgrade its supply-chain infrastructure and create web-based platforms to support franchise owners. Who is behind all of this innovation? An army of software developers.

Domino’s is certainly not alone; from Capital One and Tesla, to Airbnb and Nike, companies that have grown significantly in the last decade have one thing in common: they’ve become tech companies at heart. As every company strives to become a tech company, they must create an endless array of software to fuel their growth. So it’s no surprise that products enabling developers to build applications quickly, collaboratively, data-driven and productively will become the next trillion-dollar market. These companies will win the hearts and minds of developers and create the next trillion dollar category over the next decade. As an investor in software companies for over 20 years, I believe this trend is here to stay. The next trillion-dollar software market will be driven from the ground up, with developers calling the shots about what products and functionality they want. Since software developers are the very people enabling some of the world’s biggest brands to transform into technology companies, they are the modern-day kingmakers.

How will these new enterprise software companies make money if developers gravitate toward free products, open source tools and APIs? In my next few columns, I’ll delve into the emerging business models of this new trillion-dollar developer-focused software market: the API model, the freemium model, and the commercial open source model. Clearly, these methods work to generate huge revenues, as companies such as HashiCorp, Stripe, and Snowflake have shown, but they aren’t without complexity. We’ll also evaluate how companies that are part of this new trillion dollar industry in the making will have to navigate the public cloud players to avoid being squashed before reaching a breakout point, and we’ll look at the work from home movement and how it will accelerate various aspects of the developer-focused software industry.

Note: My firm, GGV Capital, is invested in and I am a board member for HashiCorp.